In the United States, adults, no matter their income, tend to face medical bill issues the most. Almost half of American adults dealt with medical bill problems in the past year, and a similar percentage of those with low or average incomes had to put off necessary care due to the costs involved.

What's even more astonishing is that high-income Americans are as likely to defer healthcare costs as people with low or average incomes in other countries.

Confused About Healthcare Costs?

Find Out How Healthcare Payment Plans Is Different from Health Insurance

The question remains - are there other ways? Considering the situation appears to be more than a fleeting phase, there have to be, and fortunately, there are.

| In this blog, we will discuss: ✔️ Pragmatic ways to handle hefty medical bills. ✔️ Healthcare payment plans, also referred to as medical payment plans or patient payment plans, as the most preferred way to pay for medical costs. ✔️ How to choose the right payment plan provider. ✔️ Why Denefits is a leading choice for both providers and patients. |

Handling Hefty Medical Bills: Know Your Options

Before deciding how to pay your medical bill, ask yourself, "What are my options?" This will allow you to make an informed decision, and most likely, a good one. So, without further ado, let's go over various options to cover your medical bills.

➡️Insurance:

A lot relies on whether or not you have health insurance and the coverage it offers. Contact your insurance provider to discuss the details of your policy, including deductibles, co-pays, and coverage limits. Make sure all your medical expenses are properly processed by your insurance company. This can be of great help.

➡️Financial Assistance:

Don't hesitate to seek financial assistance. Moreover, some hospitals offer financial assistance programs right out of the gate. In fact, some even offer sliding scale fees based on income. With that said, don't hang back from explaining your situation, and inquiring about available options to reduce your bill.

➡️Healthcare Payment Plans:

If you don't have the required insurance coverage and do not wish to resort to financial assistance, healthcare payment plans are your best option. These patient payment plans allow you to pay off your medical bills over an extended period of time, making them affordable. Consider the terms and your financial resources before deciding on these medical payment plans.

➡️Utilize Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs):

If you have either an HSA or FSA, consider using these funds to cover your medical expenses. Moreover, these accounts allow you to contribute pre-tax dollars, providing a financial cushion specifically for healthcare-related costs.

➡️Medical Credit Cards:

If you're stuck with an unprecedented medical emergency, and need immediate support to pay off medical bills, medical credit cards may also pose an alternative. However, these cards often come bearing promotional interest rates or extended repayment periods. So, be sure to go over the terms and conditions associated with these before making your decision.

Although life would be easier if medical emergencies arrived with fair warning, you will be better off having a plan that can help you get on the safer side. And for many, a healthcare payment plan seems to make the most sense. Let's get straight to it.

Healthcare Payment Plans: The Best Option To Pay Medical Bills

Notably, 1 in 10 patients have opted for a payment plan to cover their most recent doctor's visit, highlighting the growing preference for this payment method.

Potential Reasons:

- Healthcare payment plans ease the burden of medical expenses, allowing individuals to manage costs monthly.

- These patient payment plans often have lower or zero interest rates, saving money compared to credit cards or loans.

- Customized repayment schedules of such medical payment plans cater to individual financial situations, ensuring affordability.

- Hospital payment plans provide a structured option for uninsured or underinsured individuals to settle medical bills over time.

- Over time payment through such patient payment plans helps avoid significant debt accumulation and the need for high-interest loans.

- Structured patient payment plans encourage timely payments, reducing the risk of overdue bills and associated consequences.

Benefits Of Medical Payment Plans: For Patients And Providers

| Providers | Patients |

|---|---|

| Predictable and consistent cash flow, and reduced reliance on one-time payments. | Avoidance of large, upfront medical bills. Manageable monthly payments reduce financial strain. |

| Improved budgeting and financial planning, higher likelihood of receiving full payment, and minimized debts and write-offs. | Access to necessary medical services without delay, affordability of elective procedures. |

| Encourages utilization of healthcare services, enhanced patient satisfaction, and reduced risk of patient attribution due to billing issues. | Loyalty to providers offering convenient payment plans, and continued relationship with a trusted healthcare provider. |

| Positive impact on provider reputation, streamlined billing and collections processes, and lower administration costs related to collections. | Improved trust in patient-provider relationships, simplified payment process for patients, reduced paperwork and administrative burdens. |

| Proper documentation of payment plans for compliance, efficient tracking of payments and plan compliance, adherence to regulatory guidelines for financial practices, and mitigation of legal and regulatory risks. | Easier understanding of the management of bills, compliance with healthcare regulations, and avoidance of penalties or legal issues. |

| Enhanced communication about financial aspects of care. | Reduced financial stress and anxiety, increased satisfaction with the healthcare experience. |

Healthcare Payment Plans To The Rescue: Best Use Case Scenarios

- Ease out-of-pocket expenses with structured payment plans for high deductibles, providing immediate relief.

- Support ongoing healthcare needs with manageable payment plans for treatments.

- Make elective procedures accessible through budget-friendly payment plans.

- Bridge insurance gaps with payment plans for routine dental check-ups and eyeglasses.

- Encourage proactive healthcare with payment plans for preventive services.

- Enhance affordability for elective treatments through flexible payment options.

- Alleviate financial strain for fertility treatments with structured payment plans.

- Improve mental health access with payment plans for therapy and counseling.

- Assist in managing medication costs through payment plans for consistent access.

- Facilitate gradual contributions to Health Savings Accounts for high-deductible plans.

- Help cover post-hospitalization care and ongoing medical services with tailored payment plans.

Paying Medical Bills Using Patient Payment Plans

✔️Search for providers that offer healthcare payment plans: While deciding on a provider, look for those who offer patient payment plans.

✔️Contact providers for more information on their patient payment plans: Reach out to discuss setting up payment plans. Express interest and inquire about available options.

✔️Understand the terms and conditions carefully: Request details on monthly amounts, duration, and any fees. Understanding these terms is critical for avoiding any unwarranted surprises in the future.

✔️Choose healthcare payment plans as per your convenience: Weigh various payment plan options your provider offers and customize a medical payment plan aligning with your budget.

✔️Set up auto payment so you never miss a payment: Once the medical payment plan is agreed upon, consider setting up auto payment. It'll ensure you make timely payments.

Deciding On The Right Patient Payment Plan Provider: Criteria To Follow

- Prioritize providers with clear terms and communication on fees and schedules.

- Choose a provider that allows tailored hospital payment plans for diverse patient budgets.

- Opt for user-friendly platforms for easy enrollment and payment tracking.

- Ensure regulatory adherence and robust security for patient financial data.

- Select a provider that seamlessly integrates patient payment plans into your existing healthcare system.

- Take note of customer support as a crucial deciding factor to ensure patients can navigate medical payment plans without hassles.

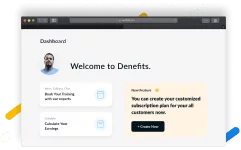

Why Patients And Providers Choose Denefits

→ Accessibility: Denefits offers healthcare payment plans even to low-income individuals, regardless of their credit score, ensuring greater access to necessary care.

→ NO CREDIT CHECK Policy: With its NO CREDIT CHECK Policy, Denefits allows providers to approve most of their patients. A win-win for everyone.

→ Customizable Payment Plans: Denefits not only allows providers the option to offer their patients to pay for the cost of care in manageable monthly installments but also decides the tenure as per their convenience.

→ Higher Approval Rate: With a 95% approval rate, Denefits provides a sense of assurance to patients while providers can cater to more patients easily.

→ Website Integration: Denefits allows providers to offer medical payment plans right off the bat through their website. This further enhances the patient experience as they can simply avail of the healthcare payment plans through the website.

→ Multilingual Payment Plans: Another prominent reason Denefits is a top choice for providers and patients is its multilingual payment plans which allow providers to cater to a wider audience and increase the patient satisfaction rate considerably.

Conclusion

It's no news that challenges in covering medical bills remain a pervasive issue in the U.S. While optimizing insurance, financial assistance, medical credit cards, and government assistance programs pose considerable options, healthcare payment plans remain a popular choice among providers and patients alike. Denefits, a leading facilitator of patient payment plans, offers a structured and accessible way to manage medical expenses, in the face of rising medical costs.

Frequently Asked Questions About Healthcare Payment Plans

1. What Is A Healthcare Payment Plan?

Healthcare Payment Plans, also known as Medical Payment Plans or Patient Payment Plans, refer to an arrangement between patients and providers to split medical expenses into manageable monthly payments.

2. How Do Medical Payment Plans Work?

Once agreed upon by the patient and provider, Medical Payment Plans simply break down the total cost of the healthcare services into manageable monthly installments. This allows patients to afford healthcare services, and providers don't have to turn anyone away!

3. Are Medical Credit Cards A Good Option For Paying Medical Bills?

Well, that depends. Medical Credit Cards are a financing option designed specifically for healthcare expenses. They can pose as a good option for covering unprecedented medical costs. However, it's crucial to understand the terms, interest rates, and potential fees associated with these cards before using them.

4. Do Hospitals Offer Payment Plans For Medical Bills?

Yes, considering the growing popularity of Healthcare Payment Plans, many hospitals provide these payment plans for medical bills.