Modern, API-Ready, and No Credit Check

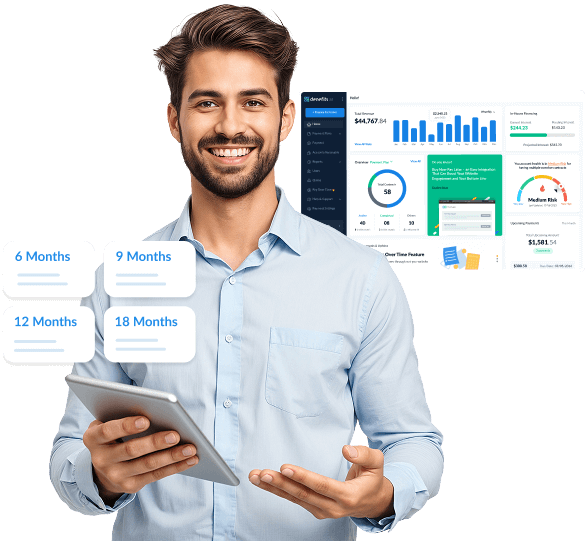

Flexible Payment Plans That Fuel Business Growth

Trusted by 300,000+ people.

Flexible Customer Financing, Increased Business Revenue

Capture More Opportunities:

Whenever traditional financing methods fall short, Denefits steps up to bridge the gap. Our platform supports businesses with no-credit-check financing, so they don’t have to turn away any potential customers. This means businesses secure more sales while customers can access the services they need, facilitated through Denefits’ automated system.

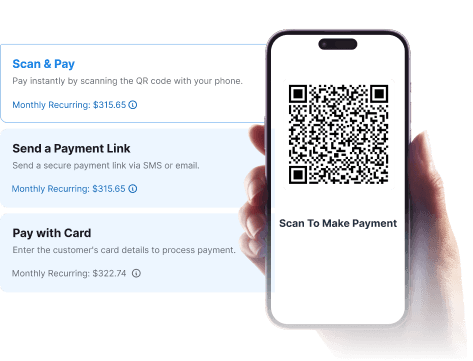

Versatile Payment Options:

We understand that every business is unique, which is precisely why each financing option has been designed in a way that helps businesses meet different needs. Our platform boasts a range of payment options to meet the diverse demands of both your business and your customers.

Seamless Integration for Maximum Benefits:

Incorporating Denefits into your existing website or system is pretty straight forward, requiring minimal effort and resources. This ease of integration ensures a more efficient workflow and a smoother customer experience.

Reliable Revenue Stream:

Denefits not only helps build a steady stream of recurring income but also ensures payment protection for uninterrupted cash flow. This is essential for financial planning and stability to expand future business operations.

Building Lasting Customer Relationships:

By offering flexible financing options, you not only increase your revenue but also build positive customer relationships. Satisfied customers are more likely to return and also refer others, strengthening your business reputation and driving growth.

Our Key Offerings

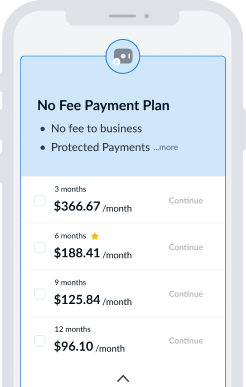

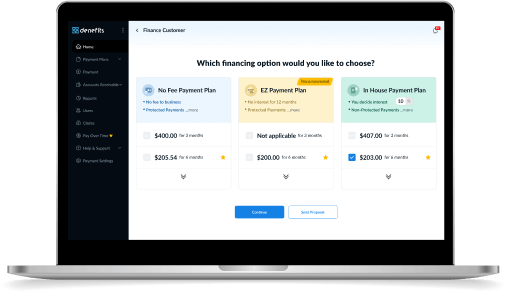

No Fee Payment Plan

This payment plan empowers businesses to finance customers, irrespective of credit scores, while enjoying full payment in recurring installments - without additional charges/deductions. Denefits safeguards your revenue against missed or delayed payments, allowing you to cater to more customers with less risk and more surety.

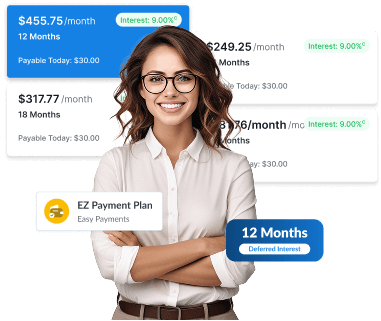

EZ Payment Plan with 12-Month Deferred Interest

EZ Financing with Deferred Interest comes with a 12-month interest-free option. In other words, the customers have an opportunity to enjoy 12 months of no interest or even pay the entire amount during the deferred period without having to pay any interest at all. Simultaneously, it allows businesses to enjoy faster payoffs with maximum payment security and repeat business.

In-House Payment Plan

With our in-house payment options, businesses can set their own plan terms, set the interest to their liking, and keep it all. This provides greater control over maximizing the profits from each transaction, ensuring you enjoy the optimum benefits.

A Roundup of Features

No Fee Payment Processing

This feature allows you to receive one-time payments securely and without any unnecessary hidden fees, convenience fees, or platform fees. You have the option to split or pass on the transaction fees, which provides greater flexibility. So you can save more on the merchant fees that cut into your profits, and reduce operational expenses significantly.

Accounts Receivable (AR)

Denefits AR offers a perfect blend of automation and ethical debt collection approach, expediting the recovery of overdue accounts. This system not only saves time but also eases the financial strain, enhancing the chances of successful debt recovery. Access to real-time data further empowers businesses to make informed decisions, ensuring proactive debt management.

Multilingual Support

Offer payment plans to your customers, and meet the unique needs of each customer efficiently in the language they prefer. Denefits supports nine languages as of now: English, German, Italian, French, Spanish, Polish, Japanese, Simplified Chinese, and Traditional Chinese with more additions down the line.

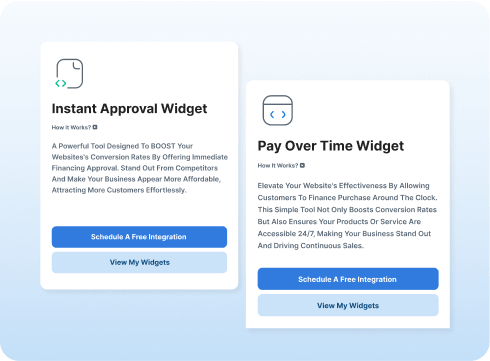

Seamless Integration

Distinguish your business from competitors by letting your customers access payment plans 24/7 directly from your website. This shows potential customers that you prioritize their needs by offering unparalleled flexibility. Denefits’ web integration capabilities and powerful APIs help ensure that the process is smooth, efficient, and effortless. So customers can view the available payment options, day or night, helping accelerate revenue generation opportunities around the clock.

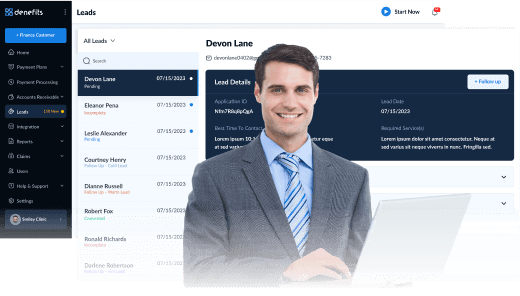

Denefits Leads

Attract, Engage, & Convert More Customers

Designed to empower your business with a seamless solution that simplifies capturing high-quality prospects directly from your website

Unlock These Key Benefits with Denefits “Leads” Feature:

-

Streamline the process by collecting valuable customer information with our pre-approval form integration.

-

Whenever a customer applies for pre-approval, it’s updated in the “Leads” section.

-

Increase the likelihood of conversions by allowing interested customers to get pre-approved in an instant.

-

Gain valuable insights into relevant prospective customers, including preferred contact methods, call times, and more.

-

This feature enables you to better engage and have productive conversations that lead to higher revenue opportunities.

Recurring Commission Opportunities With Denefits

Today, more than 300K users worldwide use Denefits, while our robust financial solutions support 100K+ businesses in their journey to sustainable success & growth.

Our partner program is not only an opportunity to grow your business network but also brings ample opportunities to earn recurring rewards.

This means, when a new business is onboard and starts referring Denefits, they don’t get commission just once, but they receive ongoing commissions every time their referred business creates a new payment plan. As a result, the business expands by actively offering payment plans, and the more they refer other businesses that use Denefits, the more your earnings grow.

Join hands with Denefits to access unmatched financing options and exclusive rewards.

A Brief Visual Tour

Experience Denefits in a nutshell! Book a demo for a quick yet comprehensive overview of Denefits' core features and benefits. Click below to see what Denefits has to offer.