Managing your business becomes simpler with smart accounts receivable solutions.

Running a business is often seen as rewarding, but few talk about the real struggles behind the scenes. Yes, managing operations, meeting deadlines, and delivering value are all part of the job. But one issue that quietly drains time, energy, and revenue is the payment collection process. Right from the start, many businesses turn to debt recovery solutions to help manage unpaid invoices and reduce the stress of follow-ups. And for good reason—getting paid on time isn’t always guaranteed, even after the service is delivered.

Moreover, recovering payments can take a serious toll on your workflow. Instead of focusing on growth or improving customer experience, business owners often find themselves sending reminders, handling disputes, or writing off bad debts. As a result, cash flow becomes unstable, and long-term planning takes a hit. So, what seems like a small delay in payment can snowball into a major financial setback.

That’s why understanding the importance of effective payment processes and knowing when to explore automated debt collection is crucial for any business. It’s not just about collecting what’s owed; it’s about maintaining the health of your operations.

But first, let’s understand some major roadblocks in the collection of accounts receivable.

Accounts Receivable Challenges

Why businesses need accounts receivable solutions

1. Delayed Payments

A common issue businesses face is customers not paying on time. This delays cash inflow and can affect your ability to pay suppliers, staff, or invest in growth.

More than half of all B2B sales made through invoices are past their due date.

Source: Paidnice

2. Outdated Manual Methods

If you are still using spreadsheets or paper logs, that’s risky. It increases the chances of mistakes, missed follow-ups, or forgotten invoices.

3. Limited Financial Insight

When there’s no proper system in place, it’s hard to get a clear view of unpaid accounts. This confusion can lead to bad financial decisions and budgeting problems.

4. Slow or Inconsistent Follow-Up

Chasing late payments manually is time-consuming and uncomfortable. Without consistent reminders, overdue invoices often slip through the cracks.

5. Payment Disputes & Communication Gaps

Clients might question charges or say they didn’t receive the invoice. Without organized records or conversation history, resolving such issues becomes a headache.

6. High Day Sales Outstanding (DSO)

If it takes too many days to collect payment after a sale, your business suffers. A high DSO means your cash is tied up, limiting flexibility and stability.

7. Hard to Manage Growth

As your business expands, handling receivables manually won’t keep up. More customers and invoices = more confusion unless you automate the process.

8. Frustrated Customers

When invoices are unclear or payment options are limited, customers get annoyed. This affects your professional image and might cost you repeat business.

Overcoming these challenges is easy with accounts receivable systems. So,…

What are Accounts Receivable Solutions

Accounts receivable solutions are like a behind-the-scenes support team that helps businesses stay on top of their payments. If you offer services or products on a pay-later basis, it is obvious that payments may be delayed. That is where automated accounts receivable systems work best.

For instance, a client’s payment is due in 14 days. The system sends a reminder 3 days before, and another on the due date. This informs customers about the payments. As a result, it reduces delays and improves cash flow. This convenience speeds up payments significantly.

What's more—some accounts receivable software provides a dashboard to manage all the invoices. It may include details related to customers who often default on payments. Moreover, it may show successful and pending payments.

Benefits of Accounts Receivable

Using an accounts receivable system comes with several key benefits, including:

1. Improved Cash Flow

When payments come in on time, your cash flow stays healthy. This means you can pay your suppliers and manage daily expenses. Moreover, if you are planning to invest in growing your business, that becomes easy without a cash crunch.

2. Less Administrative Work

Technology obviously works better and faster than human efforts. This is why getting accounts receivable software can save hours of manual effort. As a result, your team can spend more time on things that truly matter, like customer service or strategy.

3. Fewer Errors

Manual processes are prone to mistakes. On the other hand, accounts receivable solutions reduce data entry errors and missed follow-ups. This helps avoid disputes, delays, and potential revenue losses.

4. Real-Time Insights

You get instant access to reports showing unpaid invoices, aging summaries, and customer payment trends. This helps you act early and make better financial decisions.

5. Stronger Collections Process

If a payment is overdue, accounts receivable solutions can escalate the issue. This adds a layer of control and professionalism to your collections strategy.

6. Increased Scalability

As your business grows, managing receivables becomes harder to manage. Therefore, accounts receivable solutions ensure consistency and control. You won’t need to double your team just because you doubled your clients.

Accounts receivable solutions offer great benefits, so it’s no surprise that more businesses are using them. Still, to make them work best for your setup, these tips will help you customize and improve the process.

Want to Scale Faster? See How Automation in Debt Collection Makes It Possible

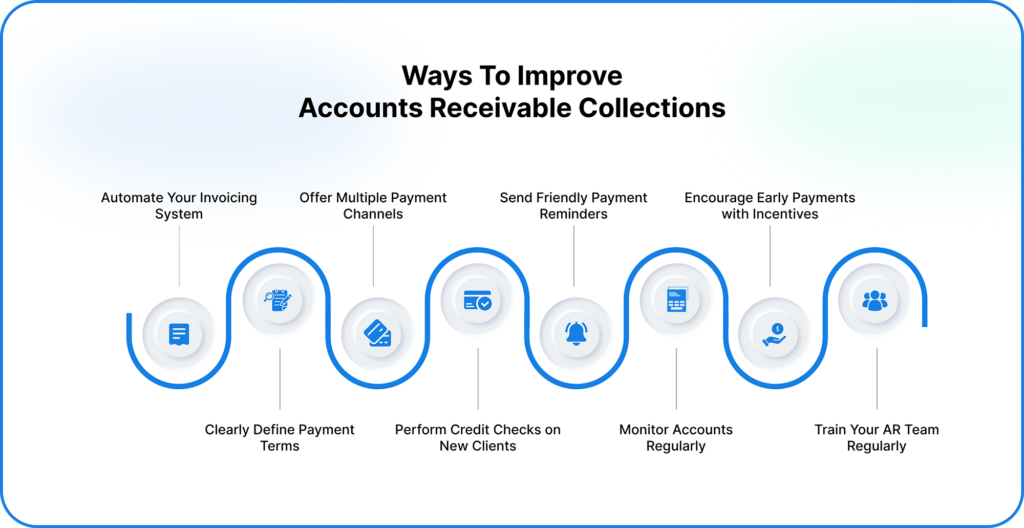

Accounts Receivable Process Improvement Ideas

Ways to do it right

1. Clearly Define Payment Terms

Make sure all customers are aware of your payment terms from the start. Clearly state due dates, penalties for late payments, and accepted payment methods on every invoice and agreement. As a result, there’s less room for confusion or disputes.

2. Offer Multiple Payment Channels

Providing various payment options, such as online transfers, credit cards, mobile wallets, or payment plans, makes it more convenient for customers to pay. Consequently, this increases the likelihood of on-time payments.

3. Perform Credit Checks on New Clients

Before extending credit, conduct credit assessments to gauge the reliability of new clients. By doing so, you reduce the risk of late or non-payments from high-risk accounts.

4. Send Friendly Payment Reminders

Timely and polite reminders can nudge clients to pay before the due date. Therefore, use automated reminder emails or SMS to keep payments on track without damaging client relationships.

5. Monitor Accounts Regularly

Furthermore, keeping a close watch on aging reports and overdue invoices helps identify problem areas early. This way, you can take proactive action before a small delay turns into a bad debt.

6. Encourage Early Payments with Incentives

Another effective strategy is to offer small discounts or incentives for early payments. Not only does this improve cash flow, but it also motivates clients to prioritize your invoice.

7. Train Your AR Team Regularly

Lastly, continuous training ensures your AR staff stays updated on best practices, new technologies, and communication techniques. In turn, this enhances efficiency and professionalism.

And last but not least,

Invest in an Automated Accounts Receivable System

When your accounts receivable payment process and collections are automated, many of the everyday struggles disappear. Instead of manually creating invoices, sending reminders, and tracking payments, the system does it all for you—automatically.

What Happens When You Automate Accounts Receivable

- Invoices are sent out on time.

- Payment reminders go out without you lifting a finger.

- Payments are tracked and recorded without manual entry.

- Overdue accounts are flagged early, so you can take action faster.

Managing collections becomes simpler with AR tools. Yet, if recovering certain payments becomes a struggle, you’ve still got another route to take.

Financial Recovery Services

It focuses on what happens after an invoice becomes seriously overdue. These services specialize in recovering outstanding balances through more advanced methods, such as collection calls, legal notices, or third-party agencies.

In short, if your AR solution is your proactive shield, financial recovery is your backup plan, ensuring that even hard-to-collect payments aren’t permanently lost.

Looking a software for automated debt collection?

Denefits Automated Accounts Receivable

Everything you need in an accounts receivable solution!

Managing accounts receivable is tough, especially when you're juggling late payments, missed reminders, and manual tracking. But with Denefits' financing options, you can automate accounts receivable.

Along with providing payment plans, it automates accounts receivable and acts like a 24/7 personal debt collection team for businesses.

How Does Automation in Accounts Receivable Work: The Denefits Way

Denefits AR automation is effortless to use. If you’ve got a list of unpaid invoices, just upload an Excel sheet with the details, and Denefits takes it from there. The system will begin the recovery process, follow up with customers professionally, and help you recover the money, without needing to make any awkward calls yourself.

Here’s a list of additional features:

- Automated Reminders: Businesses don’t have to chase payments, as customers get timely reminders before and after due dates.

- Real-Time Tracking: See all your payments, dues, and delays in one simple dashboard.

- Fewer Missed Payments: The system runs on autopilot, helping you stay consistent and organized.

- Built-In Debt Recovery Tools: If someone stops paying, Denefits steps in automatically, handling follow-ups and escalations for you.

The End Note

Accounts receivable solutions can truly transform how your business manages incoming payments. However, their success depends heavily on how well they’re implemented. Even the best system won’t deliver results if it’s not set up properly. If you’re finding it difficult to make things run smoothly, Denefits financing might be the answer. It not only lets you offer easy, flexible payment plans to your customers. But also, it’s a great way for accounts receivable automation.

FAQs

1. What Is the Best AR Automation Software?

The best AR automation software depends on your business needs. However, Denefits stands out by combining payment plan options with automated collections and debt recovery features.

2. What Do Accounts Receivable Solutions Do?

Accounts receivable solutions help businesses track, manage, and collect payments from customers who buy on credit. They automate tasks like invoicing, payment reminders, reporting, and follow-ups to improve cash flow and reduce manual work.

3. Where Do I Find a Company’s Accounts Receivable?

You can find a company’s accounts receivable on its balance sheet, typically listed under current assets. It shows the amount customers owe for goods or services delivered on credit.

4. How Are Accounts Receivable Different From Accounts Payable?

Accounts receivable represent money owed to a business by its customers, while accounts payable represent money the business owes to its suppliers or vendors. In short, receivables are incoming funds; payables are outgoing.

5. What Is Accounts Receivable Software?

Accounts receivable software helps businesses track, manage, and collect payments from customers who owe money.

6. What Is Accounts Receivable Payment Processing?

Accounts receivable payment processing involves sending invoices, accepting payments, and tracking which customers have paid. It helps businesses collect money efficiently and keep their cash flow healthy.