Overview

Nue Life is committed to transforming mental healthcare through innovative ketamine therapy, including at-home ketamine treatments for convenience and accessibility across the U.S. They have supported thousands of individuals through their mental wellness journey, guided by licensed professionals. They provide comprehensive treatment programs for patients seeking relief from depression, anxiety, PTSD, or other mental health challenges.

However, they faced several challenges in managing payments and handling operations across different locations. Additionally, many of their patients experienced financial constraints. In this case study, we explore how partnering with Denefits helped Nue Life overcome the challenges and improve its bottom line.

Challenges

Cost Constraints for Patients

For many individuals struggling with depression, PTSD, and anxiety, advanced mental health treatments like ketamine therapy were out of reach due to cost and lack of insurance coverage. This financial gap held many back, causing delays or preventing individuals from seeking the life-changing treatment they needed the most.

Managing Operations Across Different Locations

Nue Life faced the challenge of maintaining consistency in financial workflows. Coordinating across various locations without a centralized system created inefficiencies, delayed follow-ups, and hindered scalability.

Administrative Challenges

Tracking payments manually made the process prone to delays and human error. Nue Life needed a seamless solution that ensured timely payments while removing administrative headaches.

Nue Life and Denefits Partnership

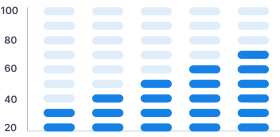

$477k+

Additional Revenue Generated

70.4%

Increased Patient Signups

$2.11M+

Annual Revenue Growth

98%

Satisfaction Rate

How Denefits Helped Nue Life Empower More Patients Through Accessible Treatment

Denefits enabled Nue Life to align its financial model with its patient-first mission. With Denefits’ seamless financing solutions, Nue Life increased access to care, streamlined its operations, and unlocked over $2M in annual revenue while staying focused on supporting patient well-being.

Implementation:

Flexible Payment Options

Offering the flexibility to pay via easy payment plans removed hesitations and empowered more patients to get the mental health support they needed. These plans ensured a recurring revenue stream for Nue Life while easing the financial burden on patients.

No-Interest Payment Plans

Nue Life utilized the EZ financing option that allowed patients to make interest-free monthly payments for a specified period with its deferred interest plan. This approach allowed them to meet the financing requirements of their patients with ease.

Predictable & Steady Cash Flow

Flexible payment plans allowed the providers to receive timely payments, ensuring steady cash flow, while patients could pay at a comfortable pace rather than being stressed about paying all upfront. Additionally, offering the EZ with Deferred Interest plan encouraged patients to pay off the balance within the deferral period to avoid incurring interest charges altogether.

Protected Payments

Denefits minimized the financial risk and cash flow interruptions by ensuring protected payments to safeguard against missed, delayed, or non-repayment issues. Hence, Nue Life could move forward with more confidence.

Streamlined Operations

Denefits’ platform streamlined the financial workflow with its centralized dashboard and multi-user management features. Hence, managing multiple locations and tracking each payment plan through a centralized dashboard became a breeze. It provided the operational efficiency and transparency that allowed Nue Life to scale its operations.

Success In Numbers

70% Surge in New Signups

With affordable, structured payment options in place, more patients signed up for ketamine therapy. Additionally, 95% of the patients received instant approvals, unlocking sustainable growth opportunities for Nue Life.

50% Boost in Operational Efficiency

Automation and real-time tracking significantly reduced delays, streamlined administration, and eliminated bottlenecks. This allowed Nue Life to reallocate more time and resources to mental wellness support.

Sustainable Revenue Growth

Flexible payment plans added over $477K in additional revenue, contributing to over $2.11M in total revenue growth within 12 months, empowering Nue Life’s long-term financial sustainability.

In Client’s Words

"Ever since we started using Denefits, we’ve been able to provide our services to more individuals. Denefits allowed us to remove the financial roadblocks many of our patients faced. Being able to offer flexible, deferred interest plans meant more people could access treatment without stress. It's been a win-win for our patients and for our mission."

— Nue Life

Discover How Denefits Can Help Transform Your Business!

Ready to enhance service accessibility and optimize your payment processes? Sign up for Denefits and join Nue Life and 100k+ businesses working towards breaking the financial barriers.

No Credit Checks

95% Approval Rate

Instant Approvals

Seamless Integration

Explore how our flexible payment solutions can elevate your success.

Book A Demo