Introduction To Claims

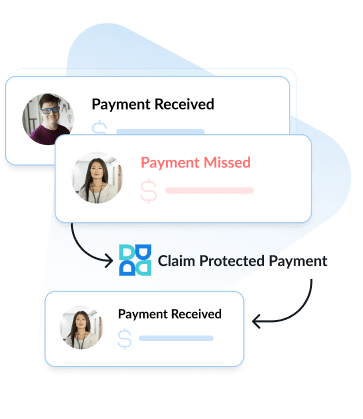

Protected Payment Claims offer a safeguard for businesses against missed customer payments. If a customer fails to make a scheduled payment, Denefits steps in to assume the outstanding debt.

We then initiate the recovery process, providing businesses with a risk-free and effortless experience in handling these financial matters.

Understanding Requirements

At Denefits, we believe in a partnership where both sides contribute actively. Our goal is to support your business by financing customers who might otherwise be denied. This approach opens up new opportunities for both your business and your customers. However, it's crucial to understand that this is a shared journey.

When additional documentation is required:

Businesses will be notified via email. Businesses will have 15 days to complete the request for additional documentation before your claim is declined.

To qualify for payments, Businesses must begin a minimum of 1 contract per month. If a Business misses a month, payments will not be approved until the Business begins creating 1 contract per month.

Protected Payment

Claim Process

1

Identifying a Missed Payment

The first step is to identify a payment that has been missed based on the agreed schedule.

2

Waiting Period

There is typically a waiting period before a claim can be filed. This period allows the customer time to rectify the missed payment voluntarily.

3

Filing the Claim

After the waiting period, if the payment is still outstanding, the business can file a Protected Payment Claim. This process usually involves submitting details of the missed payment and any relevant communication with the customer.

4

Resolution Process

The claim undergoes a review process. If it is validated, a protected payment, minus fees, is paid by Denefits to the business.

5

Recovery

Once a protected payment is paid to the business, Denefits begins the collections process to recover the outstanding debt from the customer.

Protected Payment

Advantages

Security in Receivables: This provides businesses with a reliable method to recuperate funds from unpaid payments, safeguarding their income flow.

Legal Framework: Provides a structured and legally formalized approach to debt recovery, enhancing the process's legitimacy and organization.

Maintains Customer Relationships: The structured process reduces the need for direct confrontations, helping to maintain positive business-customer relationships.

Documentation and Evidence: Promotes diligent record maintenance, essential for precise financial monitoring and audit-related activities.

Risk Mitigation: Serves as a preventive measure against non-payment, encouraging prompt payment transactions for businesses.

Professional Handling: Involves professional, objective handling of debt recovery.

Financial Stability: Assists in maintaining steady cash flow by recovering unpaid dues, essential for business operations.

Understanding Protected Claims

There's been some discussion in the business community about Denefits paying out protected claims. We want to assure you that we do honor these claims, provided the terms and conditions are met. These criteria are in place to ensure fairness and sustainability for all parties involved.

Why Your Participation Matters

Denefits takes on the risk of financing customers who may not have other financial options. This risk is mitigated by working with partners like you, who are committed to responsible business practices. Your diligence not only helps in smooth claim processes but also contributes to the overall health of our system.

By understanding and utilizing these claim processes, businesses can better manage their finances and mitigate the impact of missed or late payments.

Both Protected Payment Claims and Late Payment Claims serve crucial roles in ensuring financial stability and operational continuity for businesses. They offer structured, legal avenues for managing and recovering due payments, either missed or late, while balancing the need to maintain positive customer relations.