Introduction To In-House Payment Plan

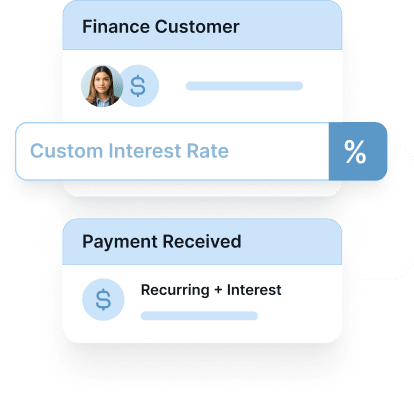

Tailored for businesses that wish to have full control over their interest rates, our In-House Payment Plan lets you set your terms and keep all the interest accrued. This plan is perfect if you're looking to maximize your revenue from each transaction.

It offers the freedom to customize payment options in line with your business strategy, ensuring you retain the most from each customer interaction.

Features of the In-House Payment Plan

Customizable Interest Rates

Set your rates, tailoring them to your business model.

Flexible Payment Terms

Design payment schedules that suit your business and customer needs.

Additional Revenue Stream

Earn revenue from the interest accrued on each transaction.

Full Financial Control

Directly manage your financing options and customer agreements.

Enhanced Customer Relationships

Foster stronger ties with your customers through direct financial interactions.

Advantages

For Businesses

Increased Revenue

Custom interest rates provide an additional income source.

Business Autonomy

Full control over terms aligns with your unique business strategies.

Market Differentiation

Offering unique payment options sets your business apart.

Customer Loyalty

Direct management leads to stronger customer relationships and loyalty.

Operational Flexibility

Adapt terms to changing market conditions or business strategies.

For Customers

Accessible Financing Options

Customers enjoy more flexible payment options.

Customized Agreements

Tailored plans to fit individual financial situations.

Improved Trust and Transparency

Direct dealings with the business enhance trust.

Budget Management

Easier budgeting with predictable and structured payment plans.

Enhanced Service Access

More customers can afford services or products with flexible payments.

Implementing the In-House Payment Plan

Business Evaluation: Assess how an in-house plan aligns with your business model.

Plan Design: Set interest rates and terms based on market research and business needs.

Policy Establishment: Develop clear policies for payment management.

Team Training: Educate your staff about plan details and customer communication.

Promotion: Market the plan to current and prospective customers.

Ongoing Review: Regularly assess and adjust the plan to ensure its effectiveness.

The In-House Payment Plan is a strategic tool that benefits both businesses and their customers. It allows businesses to enhance their revenue while offering customers more accessible and customized payment options.

This plan is not just a financial arrangement; it's a means to build stronger business-customer relationships, fostering loyalty and satisfaction on both ends.