Much like health insurance, dental insurance acts as a safety net in case something bad happens. It can help cover the cost when a random dental emergency catches you off guard. Quite often people get concerned about how expensive dental costs can get, and rightly so.

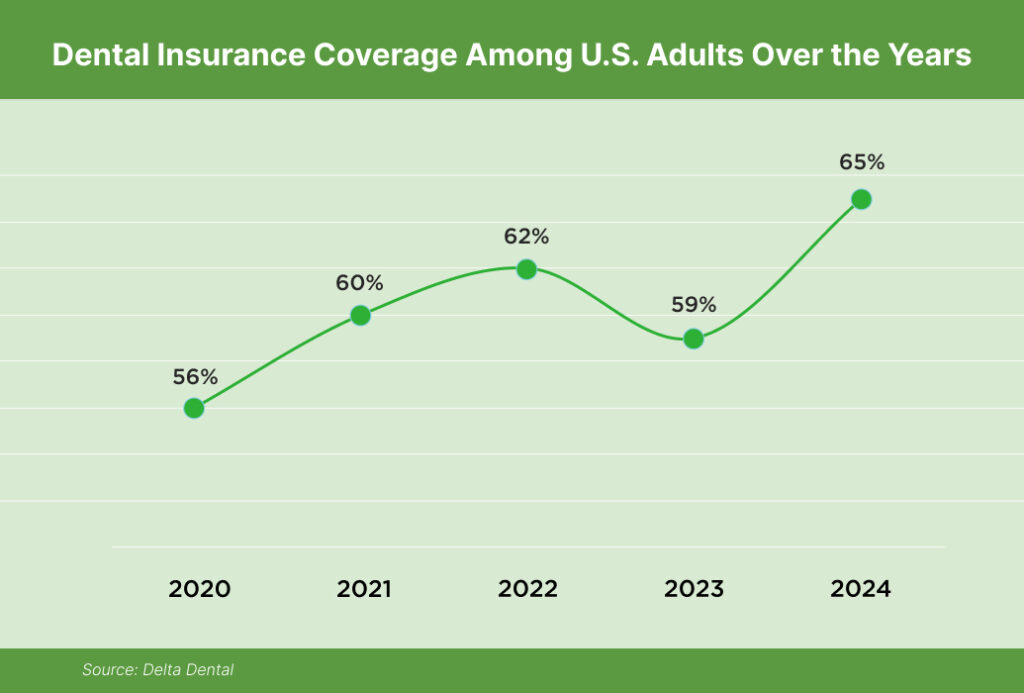

In a survey conducted by CareQuest, 68.5 million Americans didn't have any dental insurance. And lack of insurance can surely put a dent in your wallet due to the high cost of dental care. In several cases, you may have to incur out-of-pocket costs even with insurance.

This blog discusses different aspects, including when exactly is dental insurance ideal, when you need to explore alternatives, and what are the best options other than insurance.

Is Dental Insurance Worth It?

To answer this, yes, it pays to an extent when you use preventive dental services. Dental insurance indeed makes the cost of treatment reasonably affordable. Having said that, it is important to realize that for major dental treatments—cosmetic dentistry procedures in particular—dental insurance may not be able to cover the costs.

For instance, in the case of major dental surgery, dental crowns, and dental implants, among others, insurance covers only 50% (if it is applicable). But how about the rest of the expenses? Well, those you will have to cover by yourself.

Most dental plans may cover much less when you need more complex services like dental implants, which might cost over $2,000. In fact, 65% of people without insurance avoid dental care altogether due to the high upfront costs. Therefore, if you do not have full coverage/no insurance, then you should also consider other plans to help you afford the treatment.

How Does Dental Insurance Work, What It Covers, & What It Doesn’t

► Here’s how dental insurance works: You pay a monthly premium throughout the year. It's a fixed amount that you need to pay to stay enrolled in the dental plan. The amount is determined depending on which plan you have. Below is an example:

In turn, when you need dental services like routine checkups, preventive care, and other services, the insurance covers the cost.

► Dental insurance usually covers three key areas of treatment: Preventive, basic restorative care, and major dental treatments. The amount of coverage varies, but most plans follow the below pattern:

| Type of Dental Care | What This Includes | Insurance Coverage |

| Preventive Care | Routine dental exams, teeth cleanings, diagnostic services like X-rays | 100% |

| Basic Restorative Treatments | Cavity fillings, root canal, tooth extraction | 50%–80% |

| Major Tooth Restorations | Dental crowns, bridges, implants | Partial coverage, i.e., up to 50% |

| Cosmetic Procedures | Invisalign, teeth whitening, dental veneers, braces | Not covered |

► For dental treatments that aren’t 100% covered: Patients usually need to pay a minimum deductible before insurance kicks in. The deductible usually applies when you need services other than preventive care (as those are 100% covered by your plan). For any other services, an amount of $25–$75 is charged as deductible for most plans.

So, people who require major dental work or cosmetic services may not benefit as much from insurance.

How Much Is Dental Insurance?

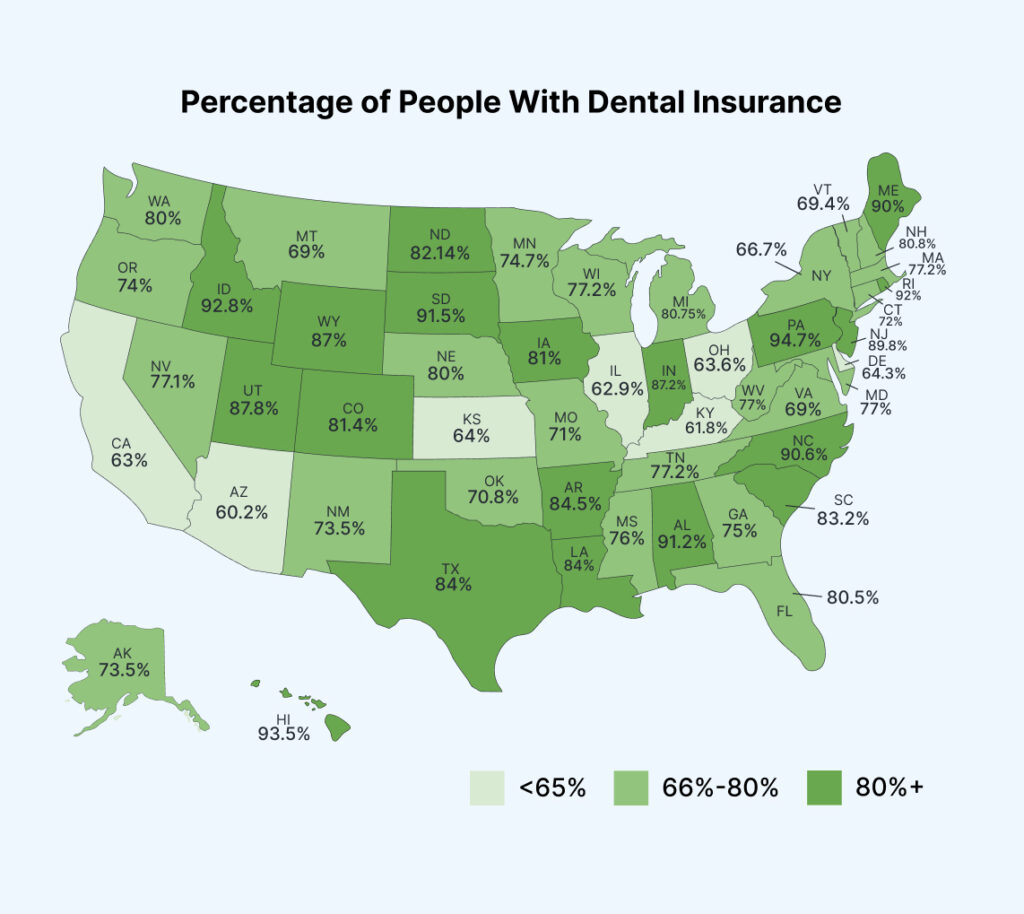

The average monthly cost of an individual dental insurance policy fluctuates between $30–$60 in most U.S. states, whereas the monthly premium for a family plan can cost $50–$75 per member, i.e., $150–$225 for a family of three. We have compiled a list of insurance coverage in each state and monthly costs in the table below.

Average Dental Insurance Coverage and Cost in 2024

| State | Percentage of People With Dental Insurance | Average Dental Insurance Cost (Monthly) | Average Monthly Premium for Individual Plan | Average Monthly Premium for Family Plan |

|---|---|---|---|---|

| California | 63% | $35.36 | $15–$63 | $75–$267 |

| New York | 66.7% | $30.17 | $20–$40 | $50–$100+ |

| Arizona | 60.2% | $31.17 | $20–$70 | $30–$100+ |

| Washington | 80% | $29.72 | $20–$41 | $75–$225 |

| Nebraska | 80% | $29.12 | $25–$47 | $75–$150 |

| Nevada | 77.1% | $33.74 | $20–$50 | $50–$150 |

| Montana | 69% | $31.57 | $25–$50 | $75–$155 |

| Texas | 84% | $29.38 | $20–$60 | $50–$150 |

| Alabama | 91.2% | $32.80 | $15–$50 | $48–$150 |

| Kentucky | 61.8% | $27.43 | $25–$50 | $75–$150 |

| Mississippi | 76% | $27.71 | $18–$45 | $75–$150 |

| Tennessee | 77.2% | $28.38 | $20–$43 | $60–$150 |

| Florida | 80.5% | $42.26 | $23–$57 | $42–$165 |

| Illinois | 62.9% | $42.74 | $27–$50 | $75–$130 |

| Pennsylvania | 94.7% | $32.18 | $15–$50 | $24–$261 |

| Ohio | 63.6% | $27.19 | $15–$50 | $30–$100 |

| Georgia | 75% | $28.24 | $15–$40 | $30–$80 |

| North Carolina | 90.6% | $36.97 | $20–$40 | $35–$110 |

| Michigan | 80.75% | $30.58 | $35–$45 | $75–$100 |

| New Jersey | 89.8% | $23.52 | $9–$45 | $50–$150 |

| Massachusetts | 77.2% | $38.42 | $11–$57 | $60–$190 |

| Virginia | 69% | $31.04 | $20–$40 | $50–$100 |

| Indiana | 87.2% | $30 | $25–$52 | $50–$150 |

| Maryland | 77% | $30.19 | $30–$45 | $50–$125 |

| Colorado | 81.4% | $31.19 | $26–$57 | $59–$150 |

| Minnesota | 74.7% | $31.67 | $35–$65 | $48–$135 |

| Missouri | 71% | $29.41 | $24–$52 | $100–$150 |

| Wisconsin | 77.2% | $31.53 | $9–$52 | $63–$190 |

| South Carolina | 83.2% | $30.06 | $10–$47 | $50–$150 |

| Oregon | 74% | $33.35 | $16–$56 | $100–$150 |

| Oklahoma | 70.8% | $29.51 | $13–$55 | $75–$210 |

| Connecticut | 72% | $36.45 | $25–$50 | $50–$150 |

| Louisiana | 88.1% | $28.11 | $10–$44 | $74–$156 |

| Utah | 87.8% | $30.39 | $20–$55 | $35–$110 |

| Iowa | 81% | $28.88 | $15–$61 | $50–$110 |

| Arkansas | 84.5% | $37.97 | $18–$45 | $80–$120 |

| New Mexico | 73.5% | $33.14 | $12–$38 | $50–$150 |

| West Virginia | 77% | $28.27 | $20–$48 | $75–$150 |

| Hawaii | 93.5% | $42.25 | $18–$50 | $70–$150 |

| Idaho | 92.8% | $30.90 | $15–$65 | $55–$110 |

| Maine | 90% | $32.57 | $21–$55 | $75–$150 |

| New Hampshire | 80.8% | $36.27 | $13–$57 | $75–$150 |

| Vermont | 69.4% | $44.68 | $37–$59 | $50–$150 |

| Delaware | 64.3% | $31.15 | $13–$52 | $75–$150 |

| Alaska | 73.5% | $33.15 | $20–$52 | $75–$150 |

| Kansas | 64% | $29.85 | $13–$38 | $100–$165 |

| North Dakota | 82.14% | $29.65 | $15–$55 | $79–$130 |

| Rhode Island | 92% | $32.14 | $15–$63 | $75–$249 |

| South Dakota | 91.5% | $29 | $15–$60 | $95–$153 |

| Wyoming | 87% | $28.84 | $11–$52 | $75–$150 |

These estimated costs can help you when you have to do the math to determine whether dental insurance is worth it or if you’re better off exploring alternatives.

4 Things to Consider When Estimating If Dental Insurance is Worth It

1. Assess Individual/Family’s Dental Needs

If you mostly use preventive and basic dental services, having dental insurance can save you hundreds. However, if you need an individual plan for preventive care, i.e., tooth cleaning twice a year, it may be cheaper to pay out-of-pocket than monthly premiums.

2. Annual Maximum Limit

At most, dental insurance plans cover up to $1,000–$1,500 a year. This provides enough coverage for basic treatments. However, major treatments like a root canal, tooth replacement, etc., can cost way more than that. In that case, exploring alternatives like negotiating a flexible payment plan may help you better.

3. History of Dental Problems

Dental insurance does not usually cover any pre-existing conditions. So, if you need dental treatment, say for tooth loss, it may or may not be covered by your dental plan if the condition predates the plan.

4. Dental Treatments That Are Not Covered

Let’s say you expect to spend on a major procedure in the future, like braces or Invisalign for children, or replacing a tooth. Then dental insurance may not be worth the cost, since it usually doesn't cover cosmetic dentistry.

Dental Costs Without Insurance

If you don’t qualify for dental care insurance, the expenses can quickly add up. Here is the cost of some of the most popular dental treatments without insurance to give you a better overview:

| Dental Treatment | Cost Without Insurance |

| Dental Crowns | $500–$3,000 per tooth |

| Dental Implants | $1,000–$3,000 per tooth |

| Root Canal | $600–$1,600 per tooth |

| Teeth Whitening | $300–$1,000 |

| Teeth Cleaning | $125–$500 |

| Dental Fillings | $200–$600 (for 2-3 teeth) |

| Gum Grafting | $600–$1,200 per graft |

| Dental Veneers | $900–$2,500 per tooth |

| Dental Bridges | $1,000–$5,000 (with 3-4 units) |

| Invisalign | $4,000–$9,500 |

| Braces | $3,000–$7,000 |

| Tooth Extraction | $70–$550 |

| Dentures | $500–$3,500 |

Does Dual Coverage Help Cover More?

Dual coverage is usually possible when both you and your spouse have coverage from an employer-sponsored plan. It’s crucial to note that dual coverage applies only to group plans, not individual plans.

When dual coverage is there, one plan is considered to be your primary insurance and the other as the secondary insurance. This way, the primary plan is billed first, and if the full cost is not covered, the secondary plan covers the remaining cost up to 100%.

Once the limit of the primary plan is reached, that’s when the secondary plan comes into play. Or if the primary plan doesn’t cover that particular treatment and the secondary plan does, then that one gets billed.

Pros and Cons of Having Two Dental Insurance Plans

Pros:

♦ Lowers your out-of-pocket costs

♦ May help reduce the burden of co-pays or deductibles of primary insurance.

♦ Charges above the maximum limit of the primary plan are covered by secondary

insurance.

Cons:

♦ You have to pay double premiums for two insurance plans

♦ It can be complex to manage two plans, especially those that have overlapping

deductibles.

♦ Until the primary plan coverage has been paid, the secondary insurance won’t kick in.

What to Do If You Cannot Get Dental Insurance?

If you do not qualify for dental insurance or the coverage provided does not align with your treatment needs, here are the other options you can explore.

1. Dental Payment Plans

Flexible payment plans make it much easier to pay off treatment costs. Regardless of whether you have insurance coverage or not, these plans can help break down the overall cost. For instance, insurance often covers only a portion of the treatment costs, so you can choose a payment plan to cover the remainder.

Nowadays, more dentists understand that dental payment plans are the need of the hour. Hence, they offer no-credit-check payment options using platforms like Denefits to patients so they get to pay off the cost in manageable monthly payments.

2. Medical Credit Cards

These cards are offered by providers, like CareCredit and AccessOne, which can be used when you need financing for dental treatments or healthcare services. These can help cover a range of treatments. However, a credit check is generally necessary, and applicants need at least a score as high as 620 to qualify.

3. Discounted Dental Package

You may also consider opting for a dental package, which is like a savings account for dental services. A membership can help you get discounts on various dental treatments. These are offered by insurance providers like Cigna and Aetna or by the dental practice for its loyal patients. These can help reduce the total payable amount.

Conclusion

Having dental insurance can positively impact your chances of affording dental care. However, if your dental needs exceed the maximum amount of coverage, you may need to pay out of pocket. In that case, it's best to negotiate a payment plan with your provider. This can help you better manage your finances while you get your desired treatment.

So, if you are considering getting dental treatment but don’t have dental insurance, make sure to discuss treatment goals, associated costs, and options to pay with Denefits payment plans with your provider.