Introduction To No Fee Payment Processing

In the No Fee Payment Processing system, while the core service doesn’t incur additional charges for businesses or customers, there is a minimal transaction fee involved in processing payments.

This tutorial will focus on the strategies businesses can adopt to manage these transaction fees.

The Reality of Merchant Fees in Credit Card Transactions

Often, the allure of credit card rewards for customers overshadows the reality of how these rewards are funded.

It's a little-known fact that the perks and rewards customers enjoy are largely financed by merchant fees – expenses that businesses such as yours incur with each credit card transaction.

How Merchant Fees Work: Each time a customer uses a credit card, the business incurs a fee. These fees are not uniform; they vary depending on factors like transaction size, card type, and your merchant service agreement.

The Hidden Cost: These fees can quickly add up, subtly eating into your profits. The most surprising part? A portion of these fees contributes to funding the reward programs offered by credit card companies. Essentially, the rewards given to customers are built off the backs of merchants like you.

The Myth of Goodwill: It's easy to misconstrue these rewards as gestures of goodwill from credit card companies. In reality, they are cleverly structured incentives, financed by the very transactions your business processes.

Why Choose Denefits for Your Payments?

Transparency and No Hidden Charges: With Denefits, what you see is what you get. Our fees are fixed, straightforward, and transparent. There are no hidden costs lurking in the fine print.

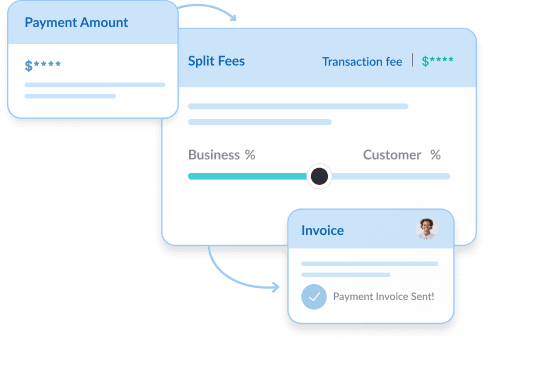

Flexibility in Fee Management: You have the option to pay the fee, or you can choose to split it with your customers, or even have them cover it entirely. This flexibility allows you to manage costs in a way that aligns with your business model and customer relations strategy.

A More Sustainable Option: By using Denefits for payments, you're not only saving on potentially high and variable merchant fees but also opting for a more sustainable financial model for your business.

Comparison of Denefits Payment Processing with Other Payment Processors

The Problem with Traditional Payment Processing for Businesses

High Merchant Fees: When customers use high-reward credit cards, the transaction fees (known as merchant discount rates) are borne by the merchants. These rates are typically higher for high-reward cards compared to standard ones.

Unpredictable Costs: Merchants often face unpredictability regarding the rate charged for each transaction, as it varies depending on the type of credit card used by the customer.

Burden on Business Finances: This structure can significantly impact a business's financial health, especially for small to medium-sized enterprises, by increasing operational costs.

How Denefits Payment Processing Offers a Solution

Flexible Fee Allocation:

- Denefits Payment Processing operates as a platform, charging a fixed percentage fee for transactions.

- This fee can be structured in several ways: absorbed by the business, passed on to the customer, or split between both.

Legal Compliance in Handling Credit Card Fees:

- Directly surcharging customers for credit card fees is often legally restricted.

- Denefits Payment Processing navigates this by charging a platform fee instead, which can legally be shared with the customer.

Reducing Merchant Fee Burden:

- When customers cover the platform fee, businesses can save significantly on merchant fees.

- This approach allows businesses to retain more revenue from each transaction.

Strategies for Managing Transaction Fees

Assessing Business Approach

Determine how the handling of transaction fees aligns with your business model, customer relations, and pricing strategy.

Options for Fee Allocation

Absorb the Fee:

The business covers the entire transaction fee. This approach can enhance customer satisfaction and loyalty but may impact the business’s profit margins.

Pass on the Fee to Customers:

Customers pay the entire transaction fee. This method ensures the business doesn't incur extra costs but might be less attractive to price-sensitive customers.